The Petroleum Industry Bill (PIB) 2018 was expected to replace Nigeria’s outdated petroleum laws. The new law would redefine the governance of the petroleum industry and propose new fiscal terms under which investors will operate. A major plank of the bill is to provide explicit terms for gas development and utilization amongst other objectives. This project models the risk posed by the proposed fiscal changes for a gas project.

The Petroleum Industry Fiscal Bill (PIFB) 2018, consistent with its previous versions, proposed to repeal the Associated Gas Framework Agreement (AGFA) in Sec. 11 & 12 of the PPTA. The AGFA incentives allow for the cost of gas utilization projects to be defrayed against oil income and have birthed several gas projects.

Therefore, this study models the risk profile of gas utilization projects if the AGFA provision is repealed as intended in the proposed PIFB 2018. There is a significant opportunity for gas utilization projects, especially for domestic purposes.

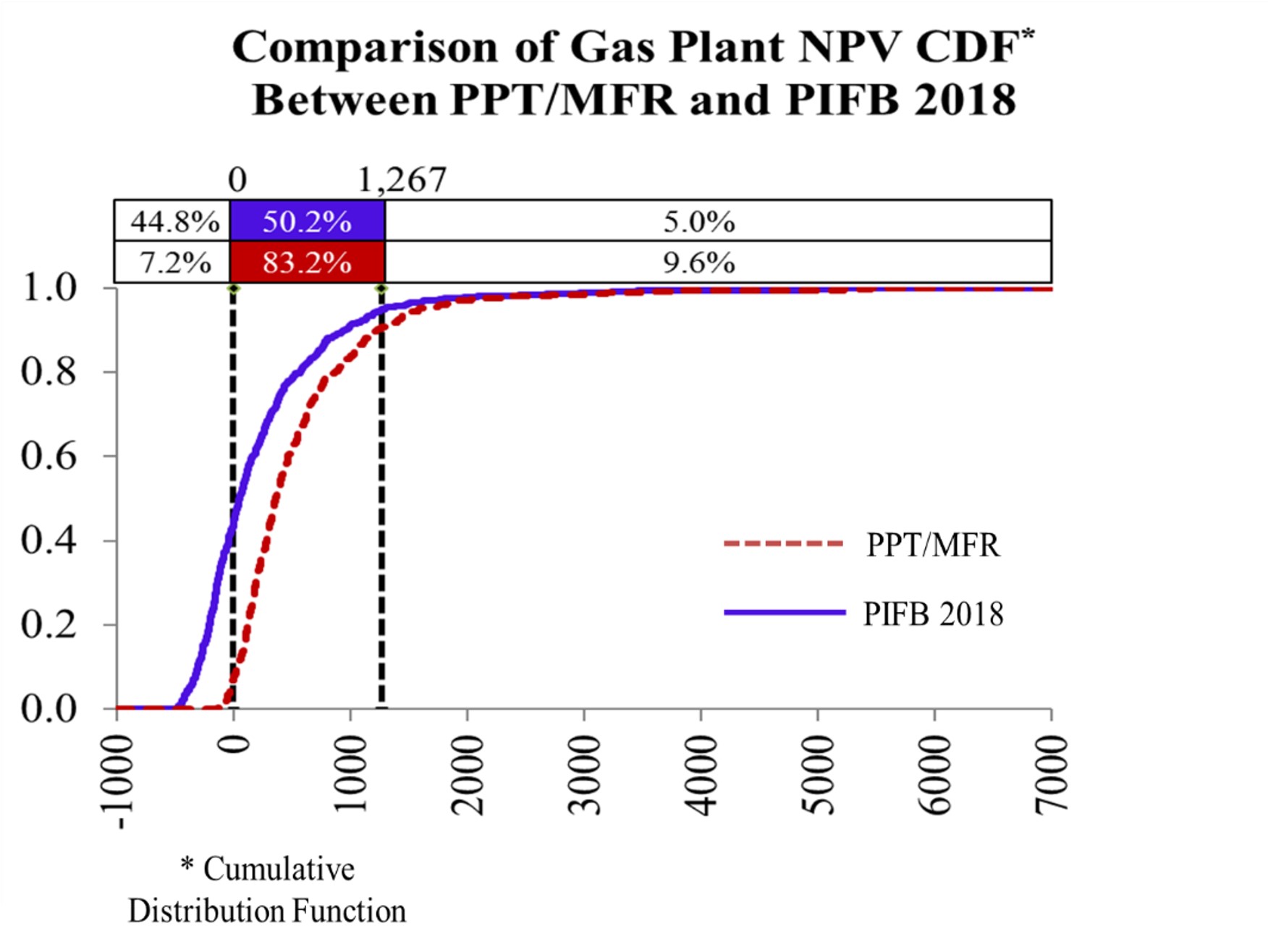

The comparative economics for a 150 MMcfd gas plant on a 250 MMboe marginal field using Discounted Cash Flow (DCF) model is assessed. The DCF incorporates sensitivity and stochastic modeling. The risk-reward profile of investor and government is evaluated and compared under the extant fiscal terms and the PIFB 2018 in which AGFA is repealed.

A key model outcome shows that, under PIFB, the likelihood of an investor loss increases six (6) times to 45% from 7% under the extant terms.

Although a broader tax base is available from upstream oil from not imposing gas development costs, the reduced tax rates in the upstream ensure the investor value is enhanced on an upstream and midstream portfolio basis – an improvement in portfolio value is seen from $480 million to $740 million.

The report can be downloaded here.